TLDR; Towards the end of 2019, the Maker project released the next major update of their system – the Multi-Collateral DAI – usually abbreviated as MCD. An overlooked component of their system is the DAI Savings Rate (DSR) – a “risk-free” way of earning interest on your DAI stablecoin holdings. In this post, we'll take a look at what the DSR is, how it works and how to keep track of your interest income.

Why should you care?

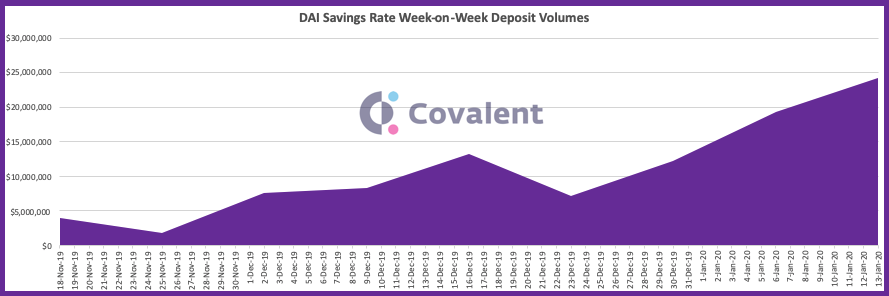

What traction looks like – w/w deposit volumes into the DSR contract (SQL source for this analysis)

The DAI Savings Rate (DSR) is a new feature of the Maker system that offers the holders of the DAI stablecoin an opportunity to earn interest income without additional risk. Before the DSR, if you held onto the DAI – it would just be sitting idle in your wallet not doing much.

One way of putting your DAI to productive use without trading or selling it is to deposit the DAI into a money-market protocol like Compound Finance or one of the other lending platforms. The problem is that you were then exposing yourself to additional smart contract risk from these external systems.

The DSR allows you to put your DAI to productive use with a native in-built feature of the Maker platform.

The difference – your risk is not any more than the risk within the Maker contracts because the DSR contracts have gone through the same set of rigor that the other Maker contracts have gone through. That's why sometimes the DSR is called "risk-free" though it actually is "no extra risk."

Additionally, the contracts have no limits on withdrawals/deposits or any kind of liquidity constraints.

You can deposit your DAI in your wallet at this very moment at the Oasis Save app. Once deposited, your DAI will continuously accrue interest based on the current interest rate.

How does the DSR work?

You can think of the DAI ecosystem as a set of supply-demand equations that maintains the DAI peg to the dollar. If for whatever reason, the supply-demand balance is thrown-off, the DAI stablecoin loses its peg to the dollar. Previously, the stability fee was the only mechanism through which the DAI was forced back on track.

The DSR is another lever introduced by the Maker system to maintain the peg. As such, the interest rate for DSR is set by the same governance process that sets the stability fee.

If you were wondering where the interest is coming from – it comes from the stability fees paid by DAI borrowers when they borrow DAI by opening a Vault.

Covalent can help you track your earnings

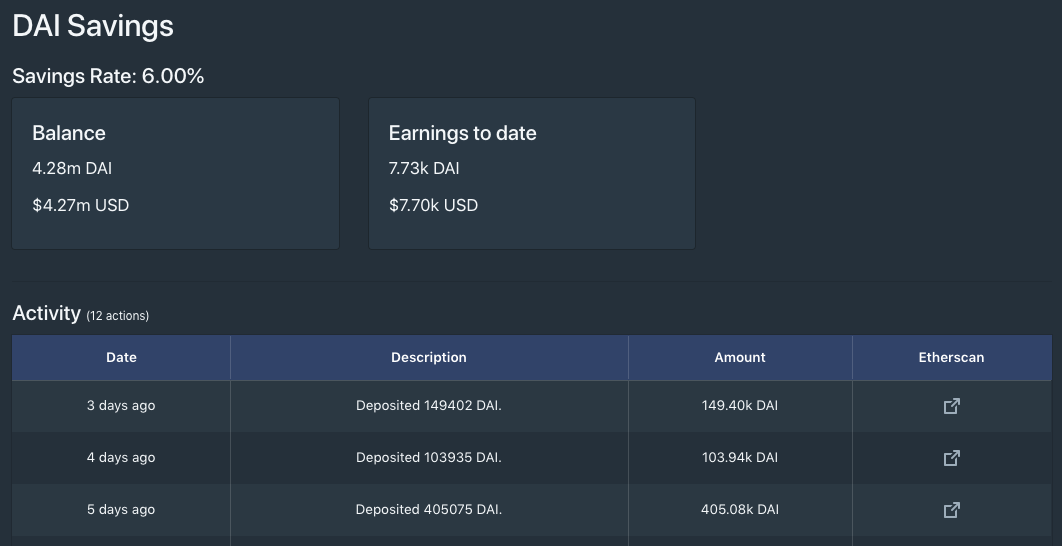

A whale has deposited 4.28m DAI into the DSR contract and has earned 7.73K DAI so far.

Covalent recently shipped an integration with the DSR contracts to keep track of your interest income. We are solving three pain-points for the investors:

- PnL – Your earnings to date updated every block.

- Notifications – Alerting when the interest rate changes so that you can evaluate whether you want to continue to invest in the system, or look for other opportunities.

- Record keeping – A history of interactions with the DSR contract for tax season.

We are calling this product "SafeKeep" and you can sign up for our private beta today:

Follow the conversation on Twitter

1 Nov 2019 was momentous for the #DeFi community. The @MakerDAO project released its next major update: the Multi-Collateral DAI. 🎉🥂Today I want to highlight an overlooked component of the system called DSR – DAI Savings Rate. 📢A thread ⬇️⬇️⬇️— Ganesh Swami (@gane5h) January 22, 2020 <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>