TLDR; Last week, we officially launched the public beta of SafeKeep and discussed two key features aimed at sophisticated DeFi investors. Today, we are showcasing another use-case: Compound Finance tracking. Compound Finance, one of the leading DeFi protocols has just begun the distribution of its native governance token – COMP. In this post, we will showcase the features of SafeKeep that make it one of a kind.

A brief intro to the governance token COMP

The gist of how COMP is earned:

“ Every Ethereum block, 0.50 COMP will be distributed across ETH, DAI, USDC, USDT, BAT, REP, WBTC and ZRX markets, proportional to the interest being accrued in the market; as conditions evolve, the allocation between markets is updated by invoking the refreshCompSpeeds function. Within each market, half of the COMP is allocated to suppliers, and the other half to borrowers.

Source: Compound Finance proposal 7 to distribute COMP to users.

The launch of the COMP token has sparked a new cycle in DeFi: "liquidity mining", or more colloquially known as "yield farming." Much has been written about this process, and so, we won't rehash this here. Here's a very good video by Defi Dad who is using InstaDApp to maximize earning COMP:

Countdown #8: Integrated view of your Compound positions

The video above has a few things of note. DefiDad starts off lending 100 DAI, but with the use of a flash loan, he's able to lend 200 DAI and borrow 200 USDT. The use of leverage allows him to earn more COMP tokens everyday.

From a record-keeping perspective, here's what we are interested in:

- One or more InstaDApp smart contract wallets to organize your positions

- The flash loan to maximize COMP earnings

- Gas costs for each transaction

- Export to your favorite app

SafeKeep, which is powered by Covalent's SDK has built an integrated interface for all of your Compound positions. Let's go over the details now.

If you're impatient, check out DeFiDad's live data:

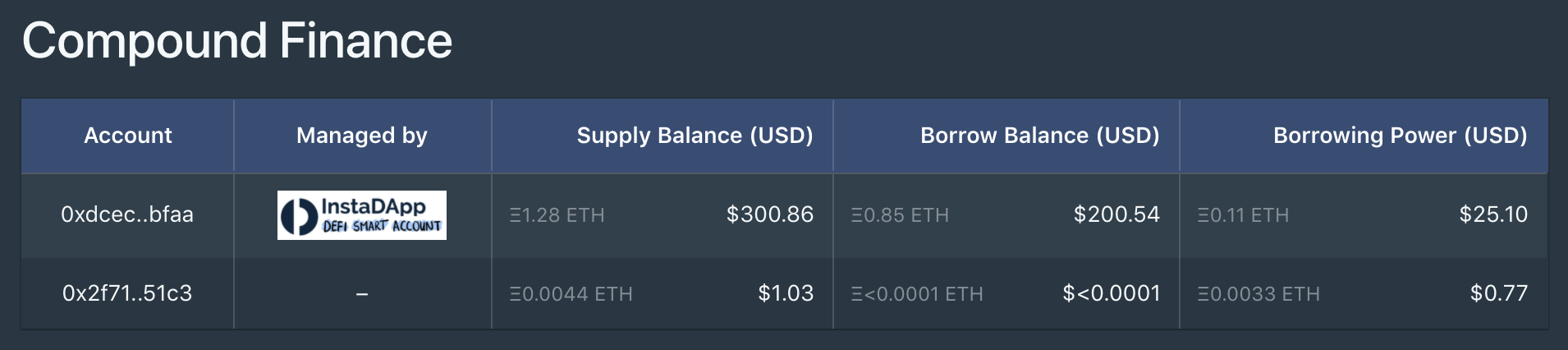

1. Pulling out your secondary wallets

When you lookup defidad.eth on SafeKeep, it can pull out all of your associated secondary wallets automatically. In this particular case, they happen to be InstaDapp's Smart Accounts. As you can see in the screenshot above, the secondary wallets have different addresses.

Your secondary wallets are automatically added to the multi-wallet interface. Everything's automatic – any future secondary wallets you create are automatically picked up.

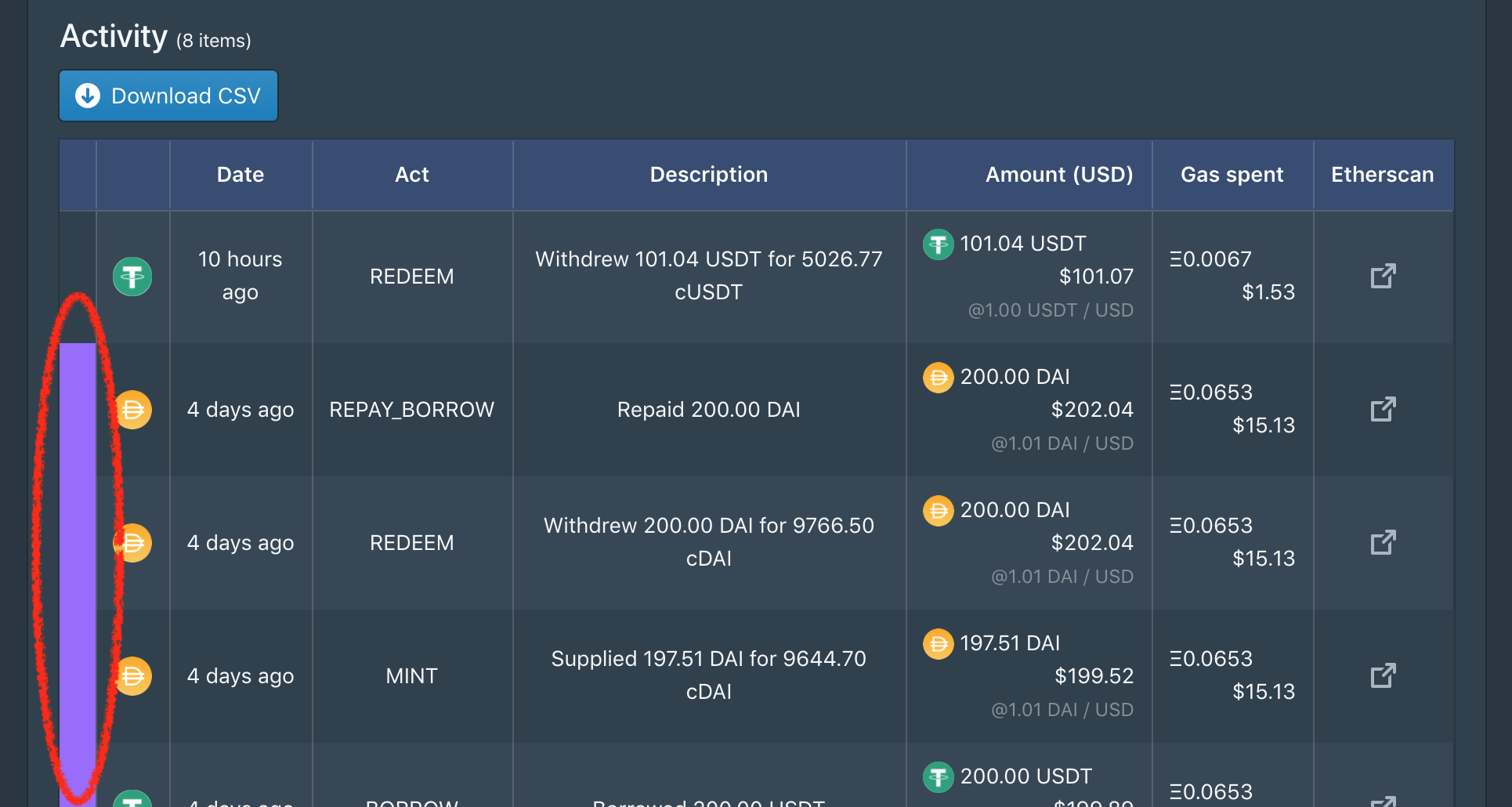

2. Understanding flash loans

SafeKeep can unwrap your transactions to understand how your balances are changing mid-transaction. In the screenshot above, the transactions are grouped by a dark vertical purple bar on the left hand side. You can clearly see that the first action in the transaction is lending 200 DAI and the last action is repaying the 200 DAI.

3. Gas costs

With all the congestion on Ethereum, gas costs can vary widely and it can be challenging to understand if you are net-positive. SafeKeep converts all of the gas costs into USD prices as of the time of the transaction for easy record-keeping.

4. Export to your favorite app via CSV

There's a lot more data behind the scenes compared to what we are able to display on the screen. We have therefore added a "Download CSV" button that neatly exports all of the above data in addition to other balances that change.

Give SafeKeep a go!

There's a lot more to SafeKeep than the features we've described. Why not give it a go with your address?

Open to any and all feedback.

What’s Next?

In the next post in the series, we take a look at how we are able to unroll transactions to understand mid-transaction balance changes.