TL;DR:

- A free e-book exploring GameFi through in-depth, on-chain data analysis into the top blockchain games.

- Using Covalent, we’ve analyzed over 4.7B rows of data across Avalanche, Polygon, Ronin and BSC to bring you reach, retention and revenue metrics around these games.

- Foreword from Sandeep (@sandeepnailwal), Co-founder of Polygon.

- Axie infinity has distributed over $3.1B in rewards to the community.

- Pega renters in Pegaxy are making an average of $845 per month just by playing the game for free.

- BombCrypto has seen strong monthly retention rates above 50% even amidst a 70% token price decline.

- The top 11 earners on Crabada have earned more than $5M collectively in the past three months.

1. Why is GameFi exciting

Video games are currently enjoyed by billions of people around the world. Some of the biggest gaming franchises on the market like Call of Duty, Minecraft and GTA choose to monetise their user base through a ‘Pay-to-Play’ model. However, many traditional gaming studios have started to see a majority of their revenue come through in-game purchases like skins and DLC packs. As a result, numerous games have shifted to a ‘Free-to-Play’ (F2P) model in which the game developers do not charge the player to join. We are currently seeing the emergence of a third phase known as ‘Play-to-Earn’ (P2E) - commonly referred to as GameFi - which has been brought to popularity by Axie Infinity. P2E games distribute NFTs and/or in-game governance tokens through gameplay, enabling the game to be owned and governed by the communities that play them.

Despite the incredible growth and excitement around P2E, the GameFi space won’t ever reach its full potential without first understanding the data around user behaviour. Although blockchain-based games purport all data to be public – deep, granular data on these chains is extremely difficult to find, organise and understand. The lack of quality analytics creates a barrier to entry for anyone trying to navigate this new and exciting genre of Web3.

However, the Covalent API supplies full blockchain data transparency for every transaction, game event, and value transfer across 28 major chains. Using 4.7B rows of data, Infinite Games explores the 3 most important metrics to describe the behaviour of users in the GameFi ecosystem.

Reach - The growth of new players.

Retention - How many players does the game retain over time.

Revenue - How much money is captured by the different parts of the ecosystem.

Quote from Ganesh Swami, CEO of Covalent

“ As GameFi continues to grow rapidly throughout 2022, the space will attract a lot of unwarranted, misleading noise - similar to what NFTs saw in 2021. Cutting through this noise will be crucial as bad actors, scammers and traditional media take advantage of this new technology; and the hype it brings. Covalent is committed to providing the market with the on-chain analysis it needs to truely understand what's happening in GameFi.

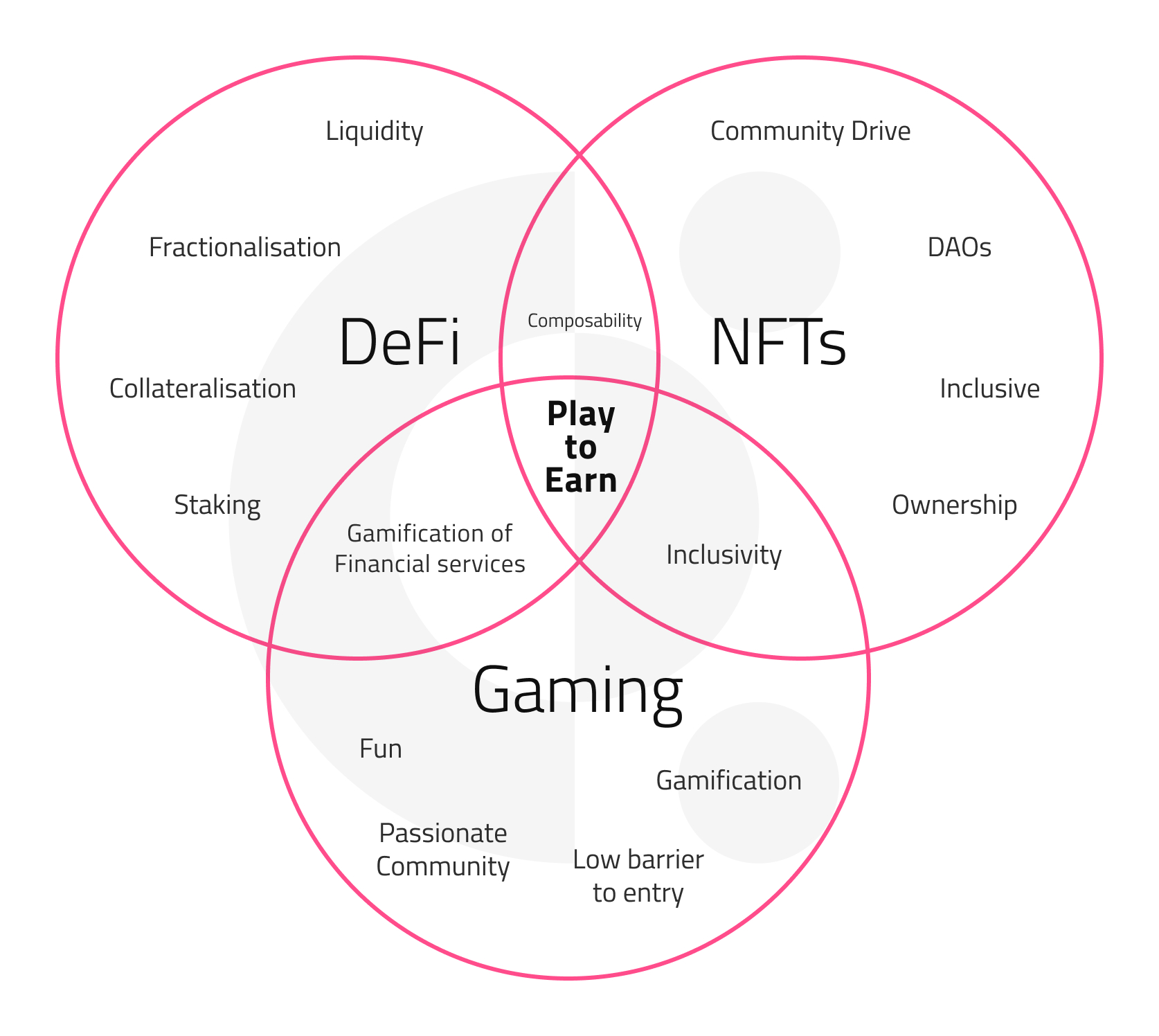

2. P2E Is The Combination of DeFi, NFTs and Gaming

Gaming is responsible for some of the biggest and most passionate communities in the world. The element of fun coupled with a low barrier to entry has facilitated the growth of gaming communities to 10s of millions of players.

NFTs have enabled ownership over the communities people participate in which has opened up endless possibilities for user acquisition, retention and monetisation.

Ownership has unlocked composability in DeFi meaning users can freely trade, stake and collateralise the assets they acquire through participating.

P2E is at the intersection of all these, making it one of the most exciting innovations in the space to date.

3. Competition Is Heating Up

Axie Infinity is currently top-of-mind for anyone looking into blockchain based gaming. However, $4B in funding has flowed into 100s of new and exciting games looking to take this top spot. Infinite Games explores the top game on Avalanche, Polygon, Ronin and Binance Smart Chain (BSC).

Axie Infinity, Pegaxy, Bomb Crypto and Crabada have all seen significant growth in users, transactions and volume as gamers start to embrace the benefits of playing on alternate L1s and L2s. The broader NFT market might be able to get away with high Ethereum gas fees but the success of these games is a testament to gamers intolerance of slow and expensive transaction fees. Each of these games have different economic models, gameplay, barriers to entry and mechanics which are all explained in Infinite Games. Analysing such a diverse range of games gives you great insight into what's possible with blockchain technology.

4. Everyone is looking for data

Irrefutable on-chain analytics is the only way to ‘cut through the noise’ and gain insight into real versus botted user growth in GameFi. To further expand on this, we asked Sandeep (@sandeepnailwal), Co-founder of Polygon, to give his thoughts on our e-book.

“ GameFi, like DeFi in 2020, is confusing and ambiguous to investors, new entrants, and the general public as the market lacks the educational resources to on-ramp participants. Before GameFi can continue progressing and reach its full potential, market participants, especially builders and investors, should have a fundamental understanding of user behaviour, gaming economics, retention metrics and overall economic health. – Sandeep, Co-founder Polygon

The entire GameFi community is vibrant, fun and rapidly growing but the sad reality is that users can’t fully understand the ecosystem they use without granular analysis of blockchain data. Covalent’s unique data architecture makes it the only product that can create this level of granular tooling required to piece together analysis on Avalanche, BSC, Polygon, Ronin and the 26 other chains we index.

We are excited to add value to the GameFi community in the best way we know how - with data.