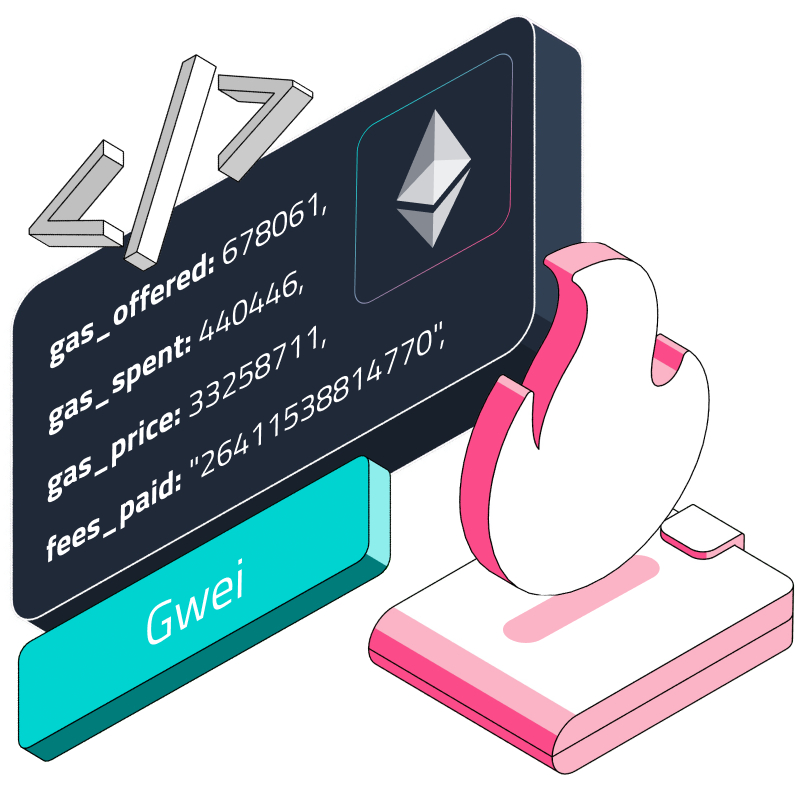

Have you ever looked into the details of a crypto transaction, such as transferring crypto assets to a friend, and encountered the term "Gwei" in the transaction details, as shown below?

Ever wondered what Gwei is and why it matters for your Ethereum transactions? This article is your guide to understanding the secrets of Gwei. We'll discuss its origins and demystify everything you need to know about this vital component of the Ethereum ecosystem. If you're ready for this informative journey, let's get started!

Gas Fees in Ethereum Transactions

On Ethereum, validators expend computational resources to process transactions, using their hardware and electricity to ensure network security and integrity. To compensate validators for this effort and incentivize network participation, users pay transaction fees, known as gas fees, denominated in a unit called Gwei.

When an Ethereum transaction is executed, it triggers the Ethereum Virtual Machine (EVM) to run the transaction's associated smart contract code if any. This computation consumes energy and storage resources of the distributed nodes that make up the Ethereum network.

To incentivize validators to validate transactions and maintain the ledger, gas fees are paid by users. The amount of gas required, and thus the fee owed, depends on the complexity of the transaction and the load on the network. Simple transactions like sending Ether require less gas than deploying or interacting with smart contracts.

What is Gwei?

Gwei is short for gigawei, where “giga” means one billion, and “wei” is the smallest fraction of Ether. It's also called nanoether or shannon and is a denomination used to precisely measure fractions of the cryptocurrency Ether (ETH).

1 Ether (ETH) is equivalent to 10^18 wei, the smallest unit of Ether. So, one Gwei equals one billion wei or 0.000000001 ETH. Since transaction fees are often very small fractions of Ether, expressing them in Ether would involve many decimal places, making it inconvenient. Gwei, which equals 10^9 wei or 10^-9 (0.000000001) ETH, provides a simpler way to state these small amounts. By using Gwei, users and developers can set transaction fees with the right level of accuracy without dealing with excessively large or small numbers.

This practice of using smaller units like Gwei is similar to how many traditional currencies have smaller units (like cents to dollar) for handling transactions with smaller amounts. In the context of Ethereum, where transaction costs can vary greatly and are sensitive to network conditions, having a unit like Gwei helps users accurately set and understand transaction fees.

For example, running a simple transaction on Ethereum costs 21,000 units of gas. With gas priced at 100 Gwei for instance, the transaction fee would be 0.0021 Ether, or 2,100 Gwei. Don’t worry, the details and calculations of this will be further discussed as we proceed.

The concept of gas and Gwei allows fees to be predictably and fairly paid by users based on computational demand. Understanding these units is essential for measuring the costs of transacting on Ethereum.

Gwei Origin

“Wei” as the smallest unit of Ether traces back to a tribute by Ethereum developers to Wei Dai, a computer scientist celebrated for his great contributions to cryptography and the development of crypto assets. In recognition of Wei Dai's impactful work, the developers chose to name the smallest denomination of Ether after him. The term “Gwei” was also named after a famous mathematician and cryptographer, Claude Shannon, known as the “father of information theory.”

It was originated due to the need to quote small amounts of ETH for transaction fees on the Ethereum blockchain. As opposed to ether, which is too large of a unit for fees, Gwei allows specific fee amounts to be set using an appropriate number of decimal places like I mentioned earlier. So there are 1,000,000,000 Gwei per ETH. This parallels common divisions of other cryptocurrencies - for example, 1 Bitcoin can be divided into 100,000,000 satoshis.

By using Gwei instead of ether, transaction fees on Ethereum can range from single-digit amounts to several dollars worth when quoted. This improves usability and understanding of actual network costs for end users. As Ethereum has grown, quoting gas prices accurately using Gwei has become important for smooth interactions.

How Gwei is Used to Calculate Gas Fees

When a user sends an Ethereum transaction, their wallet software like Metamask automatically estimates an appropriate gas limit and gas price. The gas limit ensures the transaction can be fully processed, while the gas price in Gwei incentivizes validators to include and validate the transaction.

For example, Alice is sending 1 ETH to Bob. The wallet calculates a gas limit of 60,000 units of gas based on historical token transfers. With network congestion high, it estimates a competitive gas price of 150 Gwei.

To determine the transaction fee Alice will pay:

The gas limit is multiplied by the gas price: 60,000 x 150 = 9,000,000 Gwei

This amount in Gwei is converted to ETH using the ratio of 1 ETH = 1,000,000,000 Gwei. So 9,000,000 / 1,000,000,000 = 0.009 ETH

Therefore, Alice's total transaction cost = Gas fee (0.009 ETH) + Amount sent (1 ETH) = 1.009 ETH

By dynamically estimating gas usage and pricing gas in Gwei, Ethereum wallet software can compute transparent transaction fees for end users. The Gwei denomination underpins this entire fee mechanism.

Understanding Gas, Gas Limit, and Gas Price

To understand Ethereum transaction fees, it's important to familiarize yourself with a few key terms. While these terms have been introduced earlier in the article, we'll explain them in details in this section.

Gas,

Gas limit, and

Gas price

"Gas" refers to the unit that measures the computational work required to execute operations on Ethereum. You can think of gas as the "fuel" needed for the execution of these operations.

Each transaction then has a "Gas limit", which is the maximum amount of gas you are willing to be spent on that transaction. It’s like setting a cap on how much fuel you are willing to use. If set too low, the transaction will fail due to running out of gas. If set too high, it doesn't necessarily harm, as unused gas is refunded, but it requires a higher initial Ether provision.

There is also a "gas price", which is the price or amount of Ether you are willing to pay per unit of gas, measured in Gwei. This is like the price per litre or gallon of fuel. Offering a higher gas price can result in quicker transaction processing, as it incentivizes miners/validators to prioritize your transaction.

To calculate the transaction fee, the gas limit is multiplied by the gas price in Gwei.

Total Transaction Cost = Gas Limit * Gas Price in Gwei

For example, a token transfer takes ~50,000 gas. With a gas limit of 60,000 and a price of 100 Gwei, the fee would be:

60,000 * 100 = 6,000,000 Gwei, or 0.006 ETH

More complex smart contract functions can require 150,000-250,000 gas. When the network is congested, gas prices also spike, sometimes over 200 Gwei. Gwei lets users fine-tune fees for changing network conditions.

The Impact of Gwei on Ethereum Users

As a pricing mechanism for blockchain resources, Gwei has a significant impact on costs incurred by Ethereum users. Gas prices in Gwei can fluctuate dramatically, spiking during times of peak demand on the network. This results in transaction fees rising accordingly.

For example, a simple token transfer during minimal network activity may cost 0.0001 ETH with a gas price of 10 Gwei. But the same transaction when the network is congested can leap to 0.015 ETH with a gas price of 150 Gwei - a 150x cost increase!

Users can optimize their transactions around Gwei pricing. Checking sites like ethereum gas tracker allows them to view historical gas charts and choose lower-cost periods for non-urgent transactions. Setting manual gas prices can also reduce fees, although delays are possible if set too low.

Using Layer 2 scaling solutions or sidechains, which offer lower fees and faster transactions, can be a cost-effective alternative. These platforms process transactions off the main Ethereum chain, reducing the load and, consequently, the cost on the main network.

Understanding the dynamics between network activity and gas pricing in Gwei gives users more control over their transaction costs, especially those regularly performing transactions, as it directly impacts their transaction costs and overall experience on the Ethereum Network. By timing transactions and setting customized gas, Ethereum can remain economical to use even during volatility.

Gwei and Ethereum's Future

As Ethereum scales and evolves to meet growing adoption, there are upcoming changes that may impact gas fees and the role of Gwei.

Ethereum's transition to "proof-of-stake" consensus model with Ethereum 2.0 has improved scalability and reduce network congestion which has stabilized gas prices when the additional throughput outstrips user demand. Updates like sharding could also optimize transaction validation to require fewer computational resources per operation.

However, if adoption continues rapidly, gas usage may not see sizable decreases. Still, the usage of Gwei provides flexibility to balance fees to changes in the underlying Ethereum infrastructure. There may be some decimal shift if gas prices drop significantly, quoting fees in lower denominations like others. However the underlying Gwei model enables proper fee incentives even as the network transforms.

With many major upgrades in Ethereum's roadmap, from security to sustainability, the specifics around gas are bound to develop as well. Yet no matter the future improvements, Gwei's base ability to denominate fractional ether for fees will likely persist as a core component of Ethereum's usability and accessibility.

Conclusion

Understanding Gwei allows Ethereum users or participants to accurately evaluate and predict their transaction costs before sending payments or interacting with decentralized applications. Users can also fine-tune fees with greater precision to balance between cost and time sensitivity. For anyone wanting to harness the advantages of decentralized apps and finance, grasping the vital role of Gwei is imperative.