Understanding Fractional NFTs

Think of a world where you could own a slice of your favourite digital artwork, a share of a rare collectible, or even a portion of virtual real estate property. Thanks to blockchain technology and Non-Fungible Tokens (NFTs), this is now possible with what’s known as fractional NFTs.

As digital assets continue to evolve, fractional NFTs emerge as a groundbreaking innovation. In this article, we'll delve into fractional NFTs, exploring their significance and applications in digital ownership. But before we do that, let's briefly revisit our understanding of NFTs for those encountering the term for the first time.

Overview of Non-Fungible Tokens

Non-fungible tokens are unique digital assets that cannot be replaced or exchanged for another identical asset, unlike cryptocurrencies like Bitcoin, Ethereum, or even USDT, which are fungible and can be exchanged on a like-for-like basis. This uniqueness is what makes them non-fungible.

Let’s say you have a unique trading card, like a rare Pokemon card. This card can’t be replaced with another identical card because it has its own special features and value.

Now, you can think of NFTs as a digital version of these unique trading cards. They are like digital certificates of ownership for unique digital items such as artwork, music, and collectibles. Similar to the Pokemon card, each NFT is unique and can not be replaced with another.

Fractional Asset Ownership

Fractional ownership, also known as shared ownership, is an investment strategy that involves dividing the cost of an asset among multiple individuals who then share ownership of that asset. This approach allows investors to access assets that might be beyond their individual budgets. Examples of such assets include real estate, artwork, or collectibles. It's like a group of people coming together to collectively own something valuable, making it more accessible to each person.

Characteristics of Fractional Ownership

Let’s take a look at the key characteristics of fractional ownership.

Shared Ownership

As mentioned above, each investor owns a certain portion or percentage of the asset based on how much they invested. If there's a valuable painting, for example, each investor would own a fraction of it.

Dividend/Usage Rights

Investors may enjoy benefits such as receiving a portion of the income generated by the asset. For instance, if the asset generates rental income, each investor could get a share of that income. They might also have the right to use the asset themselves, like staying in a property they collectively own.

Responsibility Sharing

The costs associated with buying and maintaining the asset are shared among all co-owners. Whether it's the initial purchase cost or ongoing maintenance expenses, everyone contributes based on their ownership stake. It's a shared responsibility.

Benefits of Fractional Ownership

Accessibility

Fractional ownership makes it possible for investors to own valuable assets even if they don't have a large amount of money. By pooling resources with others, they can collectively own a significant piece of, let's say, a luxury property or a high-value piece of art.

Diversification

Instead of putting all their money into one asset, investors can spread their investments across different types of assets. This diversification helps manage risk because if one type of asset doesn't perform well, the impact on the overall portfolio is less severe.

Reduced Costs

Sharing the ownership and upkeep expenses means that each investor pays a fraction of the total costs which can significantly reduce the financial burden on individual investors, making it a more cost-effective way to participate in ownership of valuable assets.

Now, let’s talk about Fractional NFTs!

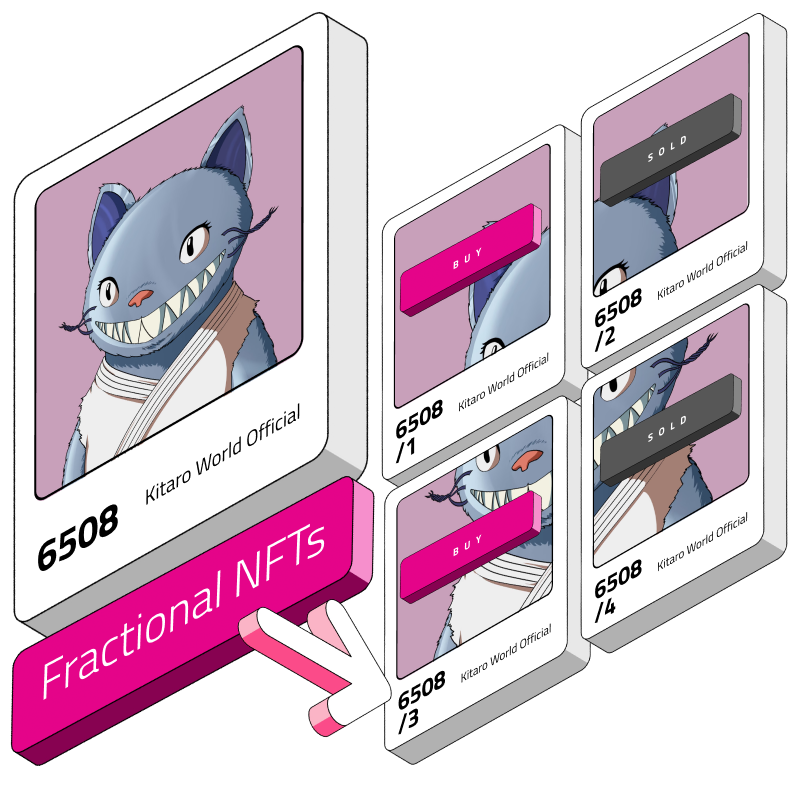

Concept of Fractional NFTs

The creation of fractional NFTs relies on smart contracts, which are automated contracts stored on the blockchain. These smart contracts define the number of units into which the NFT will be divided, keep track of ownership, and facilitate the trading of these units (tokens). Once an NFT has been fractionalized, these units can be freely traded or sold on NFT marketplaces, opening up new possibilities for shared ownership.

Use Cases of Fractional NFTs

Real Estate

One of the most important areas where the usage of fractional NFTs is very handy is in the real estate sector. NFTs are being used to fractionalize ownership of real estate. For example, a commercial property could be fractionalized into a number of units with each unit representing a share of the property's ownership rights.

Collectibles

The ownership of collectibles, ranging from rare items to cherished memorabilia, can be divided into units using fractional NFTs. This opens up opportunities for a collective ownership model, allowing multiple individuals to share in the ownership of a valuable collectible.

Art

Fractional NFTs are transforming the art world by making expensive artworks more accessible. For instance, a high-value painting can be fractionalized into smaller units, let's say 1,000 units. Each unit can then be sold for a more affordable price, such as $100, enabling art enthusiasts to own a piece of a valuable painting without bearing the full cost.

Fractional NFTs are thus expanding ownership possibilities across various asset classes, democratizing access to traditionally high-value investments.

Where to Buy a Fractional NFT

If you are interested in getting a fractional NFT, some of the top platforms for trading and buying fractional NFTs you could check out are:

Fractional.art

This platform is a leading fractionalization NFT marketplace known for its use of a permissionless smart contract protocol. It's completely decentralized and has been audited for security. The platform features over 1100 NFT vaults containing popular NFTs from collections like Cryptopunks and Etherrock.

Unic.ly

Unic.ly lets people buy and sell parts of art in a decentralized way using uTokens. It works with two token standards, ERC-1155 and ERC-721, and mainly deals with NFTs based on ETH. Along with buying and selling, it has extra features like swaps, farms, and other tools.

LiquidMarketplace.io

Logan Paul's launched marketplace specializes in breaking down both physical and digital collectibles into fractions. It stands out with unique features such as the capability to earn royalties, setting it apart from other platforms.

NFTfy

This platform supports the fractionalization of NFTs on multiple blockchains including Ethereum, Polygon, Fantom, BNB, and Avalanche. It allows users to collectively sell their shares and ensures the security and decentralization of NFTs held in contracts.

NFTX

NFTX takes an index fund approach to fractionalization, pooling NFTs of equal value similar to an index fund. Users receive NFTX, an ERC-20 token when they contribute art to an index or purchase a part of it. The platform mainly features lower-price artwork.

These platforms offer a range of options for those interested in engaging with fractional NFTs, whether it's in art, collectibles, or virtual real estate.

Popular Examples of Fractional NFTs

Some notable examples of fractional NFTs are:

Beeple's "EVERYDAYS: THE FIRST 5000 DAYS”

Beeple's iconic digital art piece, initially sold as a single NFT for a record-breaking price ($69.3 million equivalent to 42,329 Ether at that time), caught attention. Later, platforms like Fractional.art allowed the fractionalization of such high-value NFTs, letting multiple investors own a piece of this famous artwork.

Virtual Real Estate on Platforms like Decentraland and The Sandbox

In virtual worlds like Decentraland and The Sandbox, you have the opportunity to buy, trade, and divide virtual land into smaller portions. This democratizes access to digital real estate, allowing multiple investors to own shares of these virtual properties.

Bored Ape Yacht Club

The fractionalized apes from this club are gaining popularity, selling for high prices through co-ownership.

Pudgy Penguins

Taking inspiration from other NFTs, Pudgy Penguins are sold through co-ownership, allowing multiple persons to collectively own them. While the platform is gaining popularity, only a limited number of sales have been vaulted through fractional.art at this point.

CryptoPunks

As the first-ever NFTs on the blockchain, CryptoPunks have become highly expensive and are sold through co-ownership, allowing investors to own a piece of digital history.

Mutant Ape Yacht Club

A spin-off of the Bored Ape Yacht Club, these NFTs are accessible through co-ownership as well and are exclusively generated for those who have owned Bored Ape NFTs.

These examples show a growing trend in the digital asset space, applying fractional ownership to a wide range of assets. This makes them more accessible, creating new opportunities for investment.

Tutorial: How to Buy a Fractional NFT

To buy a fractional NFT, you can follow these steps:

Step 1: Choose a Platform

Select a platform that offers fractional NFTs for example NFTX.

Step 2: Set Up a Digital Wallet

Ensure you have a wallet compatible with a platform like Metamask and the blockchain it operates on. This wallet will store your cryptocurrency and fractional NFTs.

Step 3: Get Cryptocurrency

Most fractional NFT platforms require payment in cryptocurrency, so ensure you have the appropriate cryptocurrency in your wallet (e.g., Ether (ETH) for ERC-20-based platforms).

Step 4: Connect your Wallet

Connect your wallet to interact with the platform.

Step 5: Browse Available Fractional NFTs

Explore the platform to find fractional NFTs that interest you. These can range from artwork and collectibles to virtual real estate.

Step 6: Understand the Terms

Before buying, understand the terms of the fractional NFT, including your rights as a fractional owner, any potential dividends or earnings, and the process for reselling your share.

Step 7: Make the Purchase

Once you've selected a fractional NFT, follow the platform's process to make the purchase. This typically involves transferring cryptocurrency from your wallet to pay for your share of the NFT.

After purchasing, your fractional NFT (an ERC-20 token) will be stored in your digital wallet. Ensure your wallet is secure to protect your investment.

Step 8: Monitor and Manage Your Investment

Keep track of the value of your fractional NFT and any potential earnings or changes in ownership terms.

Remember, the exact process can vary depending on the platform and the type of fractional NFT. It's important to do thorough research and possibly seek advice if you're new to NFTs.

Challenges with Fractional NFTs

Although fractional NFTs offer innovative opportunities when it comes to digital assets, it is also important to point out that they have some challenges as well. Let’s quickly talk about some of these challenges.

Regulatory and Legal Issues

One of the biggest challenges of the crypto space generally is regulatory and legal issues. The legal landscape in the crypto space is complex, and fractional ownership of assets, including NFTs, may encounter legal challenges. Laws and regulations around ownership, transfer, and taxation of fractionalized assets can vary, posing uncertainties.

Market Liquidity Depth

The major aim of fractionalizing NFTs is to increase liquidity by lowering the price barrier of entry for some investors. On the other hand, there is no guarantee of a liquid market for these fractions because fractional NFTs are quite new and many buyers and sellers are yet to fully understand the concept.

Manipulation Risk

Fractional NFTs are represented with ERC-20 tokens and these tokens are held by investors owning some fractions of the NFT. There is a potential risk of market manipulation if one investor or some group of investors holds a large number of the fractions. The price of the token can drastically drop when a user with a large fraction sells their tokens to get ETH in return.

Conclusion

Fractional NFT offers a great way for investors to own expensive digital assets by splitting these assets into fractions and equally splitting the cost. This represents a significant shift in the ownership and investment of digital assets.

The idea of fractional NFTs is pretty new and also at the forefront of innovation of digital asset ownership, the future is quite green and many more pending business areas are waiting to adopt it. In another part of this article, we will cover the technical details of creating a fractional NFT smart contract. Stay tuned!